Notice: Enrolled students will have right up until the beginning of the next course session to ask for a drop by getting in contact with the Workplace of your Registrar; a college student who no more wishes to stay enrolled after the second class session commences won't be permitted to drop The category but could request a withdrawal from an instructional advisor within the Workplace of Academic Affairs.

DTL course is best with regard to running the expense advancement on wage, individual property, true property, and several more. It offers various important benefits Which benefits are specified down below:

Every seven-7 days semester avoids the chaotic tax season, with drop courses beginning after the October fifteenth filing deadline, spring courses ending the 1st 7 days in March, and summer courses offered in June and July.

An auditor is additionally liable for monitoring the economic progressions whilst guaranteeing that the organisation is functioning with comprehensive performance to boost financial gain plus the taxation program.

We are devoted to furnishing you with correct, reliable and crystal clear information to help you understand your rights and entitlements and fulfill your obligations.

The course discusses conformity with federal tax laws and introduces the student for the condition tax concepts of unitary business principle and formulary apportionment. Besides corporate income and franchise tax troubles, the course will talk about troubles referring to passthrough entities, popular planning techniques, states’ authority to challenge positions taken by taxpayers, and taxation of non-U.S. income and non-U.S. taxpayers.

States and Territories most commonly impose tax on immovable property situated in that particular Condition, and also on a variety of other condition-dependent transactions which include motor vehicle registration and work.

Also, there are statutory limitations to simply how much employers or personnel can lead to superannuation money. If contributions are made in surplus of such restrictions, a penalty demand may possibly apply.

Legislation clerk – Task purpose is always to carry out legal study, get ready drafts, memos, and converse with the judiciary to arrange and ship notices to men and women.

This course assumes that students have some familiarity with basic tax treaty concepts and examines how provisions from the OECD Design Treaty indian taxation law pdf and The us Product Treaty are utilized by tax practitioners to realize specific business targets. Students will get an understanding of how treaty provisions help shape financial and fiscal decisions in various industries and economic sectors.

This class may also examine tax obligations incurred throughout a personal bankruptcy case, cancellation of indebtedness, the termination of tax by way of a bankruptcy court docket, and related corporate tax issues.

This course experiments the regulation and polices governing the taxation of organizations submitting consolidated federal income tax returns. This course is very recommended for students who plan to practice corporate tax regulation as it will center on consolidated return principles that influence corporate tax planning, mergers and acquisitions. The course will protect the next topics: eligibility to file consolidated returns; remedy of business transactions within the group; treatment of dividends and other distributions within the team; changes to The idea of inventory of customers on the team; remedy of acquisitions of Yet another consolidated group; treatment of dispositions of subsidiaries of a gaggle; consolidated return cure with the team's favorable tax characteristics; utilization of disregarded entities by a consolidated group; and therapy of earnings and gains accounts.

The biggest challenge of the multistate tax practice is dealing with the sensible problems with several states with occasionally conflicting laws and polices. Most companies run in multistate surroundings and should learn the way to apply their operational realities to your patchwork of condition and native tax laws and restrictions.

In general, tax regulation is worried only with the legal elements of taxation, not with its economical, financial, or other elements. The producing of selections as on the merits of assorted forms of taxes, the general level of taxation, as well as prices of particular taxes, for example, would not tumble to the domain of tax legislation; It is just a political, not a legal, system.

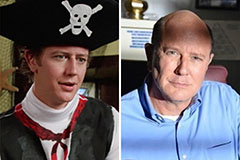

Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!